With the rising cost of living and the rise in real estate values, the search for an affordable place to live has gained significant prominence among many Americans. When it comes to buying a home in the United States, some locations are more cost-effective than others, due to a number of determining factors that define living expenses in a given region.

Given this context, Scholaroo conducted a comprehensive evaluation of key parameters, such as the average home value and the average amount of property taxes, in order to unveil the cities that offer the most cost-effective prospects for purchasing and maintaining a home among the 152 locations that were examined across the United States.

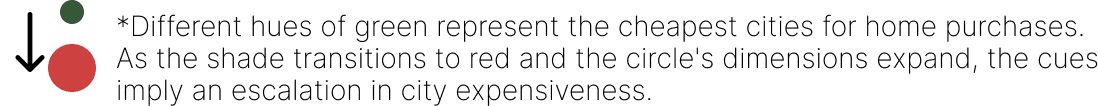

To reveal the rankings of every city on the comprehensive list or within specific categories, just interact with the map provided below!

Key findings

- Of the top ten cheapest cities to buy a home this year, nine are in the South. The only exception is Fort Wayne, Indiana, which ranks 9th overall;

- Alabama stands out for having three cities – Montgomery, Birmingham, and Mobile – as the cheapest places to buy a house in the whole country;

- 8 out of the top 10 costliest cities to purchase a home are situated within California, and among them, San Francisco stands as the second-most expensive in the nation;

- Yonkers and New York City, despite their high real estate costs, are expected to experience minimal growth in the upcoming years, with projected increases of only 0.2% and 0.43% respectively.

Projection of the median home value over the next three years

Overall ranking

Methodology

Scholaroo undertook a comprehensive analysis of 152 cities throughout the United States to pinpoint the most economical choices for home purchase. This assessment concentrated on the Real Estate Market aspect, encompassing four pertinent categories, each allocated a distinct weight. Ratings were assigned on a scale from 0 to 100 for each category, with 100 representing the highest attainable score.

Following this, the data team computed the weighted mean for each city across all categories to establish its comprehensive score. Leveraging these scores, the cities were systematically arranged to ascertain the most economically viable choices for house acquisition.

The categories:

Median Home Value: Triple Weight (42.86 points)

The median home values across the country in the first quarter of 2023.

Average Monthly Household Income: Regular Weight (14.29 points)

The average monthly household income in each state.

Mortgage Payment to Monthly Income Ratio: Double Weight (28.57 points)

The mortgage-to-income ratio in each state.

Median Real Estate Taxes: Regular Weight (14.29 points)

The annual median real estate taxes.